Default HubSpot Blog

Being part of Lux Research means constantly getting exposed to innovative ideas that our analyst teams uncover – novel technologies, creative new business models, and emerging growth opportunities. Of course, reports of new technologies purported to be transformative are a nearly daily occurrence, but they're often lacking the context or critical analysis to understand the real market opportunities and the strategies to capitalize on them. In contrast, when a Lux Research analyst spots a new idea, his first instinct is to try to break it down, poke holes in it, find out why it won't work, and in many cases, it does not pass muster. So, those that do pass Lux Research’s vetting process really have something to them, as these are the ideas that can really have an effect on our lives, our businesses, and our world.

Topics: Lux Mobility Blog

Corporate Venture Capital Bullish in a Challenging Investment [hardcoded]

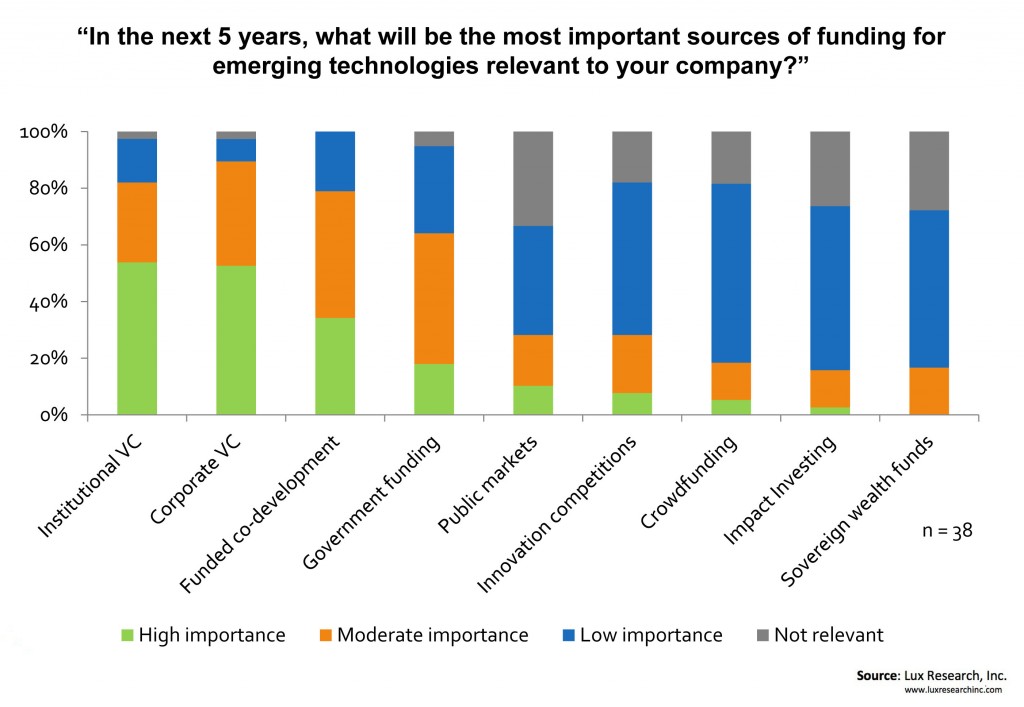

Many large companies see corporate venture capital (CVC) as a key tool for gaining access to new technologies and getting insight into emerging trends – and hopefully earning a positive financial return while they’re at it. However, a changing financial, technology, and market landscape is creating new challenges for CVCs. Conventional venture capital is retrenching to capital-light software-focused investments and backing away from capital intensive sectors, like healthcare and cleantech, where many CVCs would like to co-invest. Meanwhile, other funding sources like contests, conscious capital, and crowdfunding are growing, and will likely collectively surpass VC soon. Technology development is diversifying and globalizing, meaning that companies have to cast a wider net or risk missing critical innovations. Meanwhile, in the face of macroeconomic uncertainty, the C-suite is pressing strategic functions like CVC to show more concrete and near-term value to the organization.

Topics: Lux Energy Blog