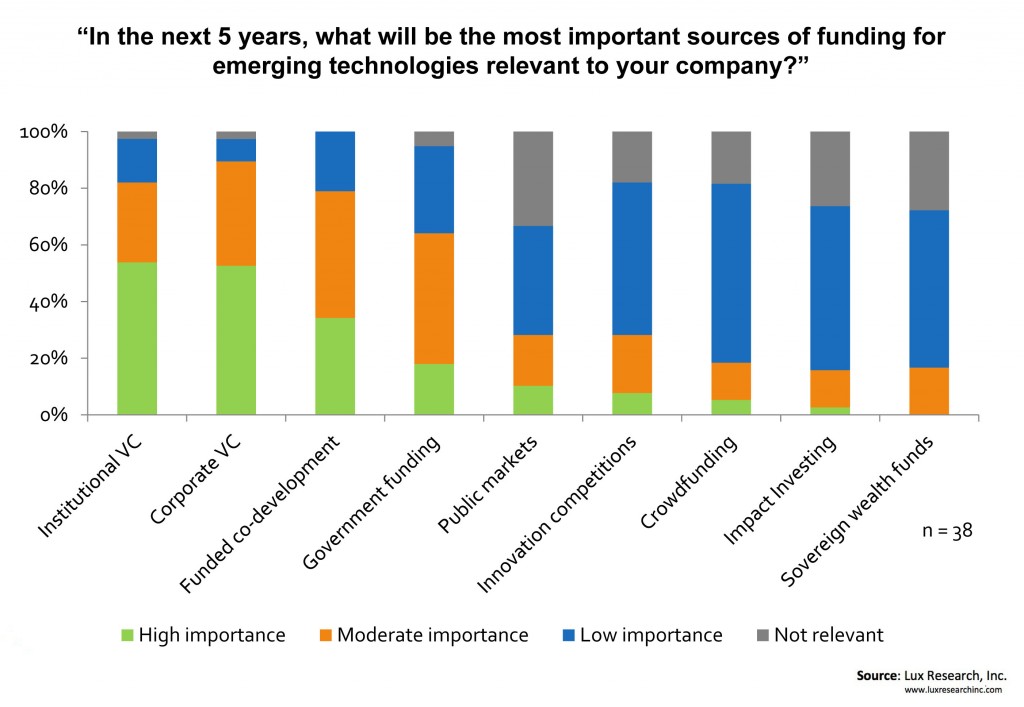

Many large companies see corporate venture capital (CVC) as a key tool for gaining access to new technologies and getting insight into emerging trends – and hopefully earning a positive financial return while they’re at it. However, a changing financial, technology, and market landscape is creating new challenges for CVCs. Conventional venture capital is retrenching to capital-light software-focused investments and backing away from capital intensive sectors, like healthcare and cleantech, where many CVCs would like to co-invest. Meanwhile, other funding sources like contests, conscious capital, and crowdfunding are growing, and will likely collectively surpass VC soon. Technology development is diversifying and globalizing, meaning that companies have to cast a wider net or risk missing critical innovations. Meanwhile, in the face of macroeconomic uncertainty, the C-suite is pressing strategic functions like CVC to show more concrete and near-term value to the organization.

Default HubSpot Blog

Corporate Venture Capital Bullish in a Challenging Investment [hardcoded]

Posted by

Michael Holman on Aug 1, 2016 7:07:00 AM

0 Comments Click here to read/write comments

Topics: Lux Energy Blog